Is Lam Research (LRCX) a Buy, Sell, or Hold? The answer hinges on a complex interplay of market forces, technological advancements, and geopolitical considerations, making this a particularly nuanced investment decision.

The semiconductor industry, a cornerstone of modern technology, is a volatile landscape. The demand for ever-smaller, more powerful, and more efficient chips drives constant innovation and fierce competition. Within this arena, Lam Research Corporation (LRCX), a leading supplier of wafer fabrication equipment and services, occupies a pivotal position. The company's fortunes are inextricably linked to the overall health of the semiconductor market and the specific demands of its customers, the companies that design and manufacture integrated circuits. This article aims to dissect the factors influencing Lam Research's stock performance, providing a comprehensive analysis to guide potential investors. We'll delve into the financial metrics, examine industry trends, and weigh the potential risks and rewards to provide a clear perspective.

| Key Metrics | Details |

|---|---|

| Stock Symbol | LRCX (NASDAQ: LRCX) |

| Industry | Semiconductor Equipment |

| Company Description | Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment. |

| Market Capitalization | (Varies, check current market data) |

| P/E Ratio | (Varies, check current market data) |

| Dividend Yield | (Varies, check current market data) |

| Key Competitors | Applied Materials, ASML Holding, Tokyo Electron |

| Geographic Focus | Global, with significant presence in China |

| Products | Etch, deposition, and other wafer fabrication equipment. |

| Recent News | Strong demand for DRAM and NAND technologies. |

Lam Research's business model revolves around providing the tools and services necessary for the creation of integrated circuits. These integrated circuits are the building blocks of everything from smartphones and computers to automobiles and industrial machinery. Their equipment is used in the complex process of etching, depositing, and otherwise modifying silicon wafers to create the intricate patterns that form the basis of microchips. The company's success is heavily reliant on the industry's capacity to generate sophisticated integrated circuits and keep innovating to meet the ever-growing demands of the tech industry.

- Cbn Ministry Impact Outreach In 2023 See Inside

- Deandre Hunter Cavs Trade Latest News Mustknow Updates

The company's stock has been the subject of extensive analysis. MarketBeat provides a wealth of information, including the latest stock analysis, price targets, dividend information, headlines, and short interest data. This comprehensive overview provides a detailed view of the company's performance and market sentiment. The fluctuation in the stock value is often discussed and scrutinized by market watchers. One of the primary focuses of the analysis is to determine whether the stock presents a buying opportunity or should be considered a potential sell.

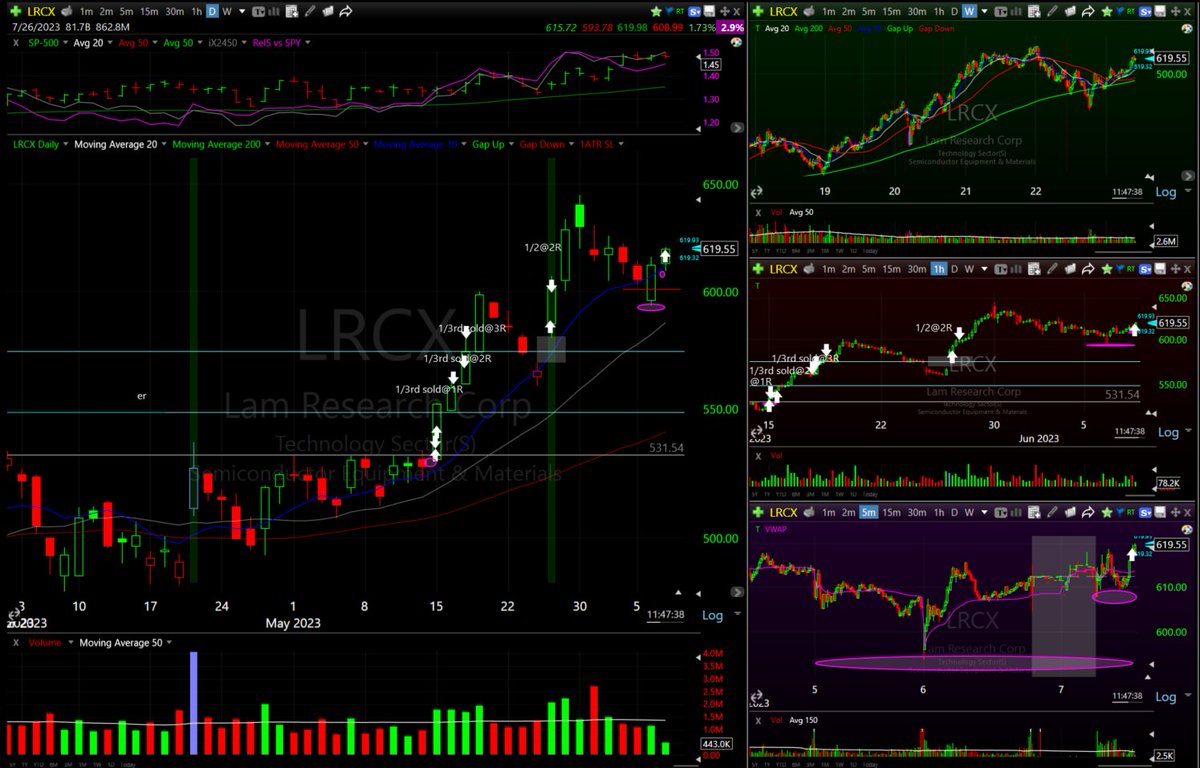

Recent trading activity has seen the shares of Lam Research (LRCX) experiencing ups and downs. A jump of 7.2% in the afternoon session was observed after the company reported strong first-quarter results. The performance underscores the sensitivity of the market to earnings reports and the companys ability to meet or exceed expectations. This reaction reflects the dynamic nature of stock prices, which are influenced by a multitude of factors, including industry trends, and overall market sentiment.

Analysts also focus on Lam Research's revenue potential, with a positive outlook for FY25, with strong expectations driven by the demand for DRAM, NAND technologies, and customer support services. This indicates the company's ability to adapt to market needs and the continued innovation in the semiconductor sector. It's essential for potential investors to consider these growth drivers when evaluating the stock.

- Rangers Vs Union Sg Europa League Preview Prediction Details

- Drake Mayes Patriots Journey From Draft To Pro Bowl Beyond

The companys exposure to China is a crucial consideration. As a significant market for semiconductors, Chinas economic health and geopolitical relations play a significant role in Lam Research's outlook. Furthermore, the ongoing tensions between the United States and China concerning technology and trade have a direct impact on the company. These risks were a significant factor that influence the performance of the stock, which is often under pressure due to the company's heavy reliance on the Chinese market.

For investors, understanding the intricacies of Lam Research's business and the external forces that affect its performance is critical. A thorough evaluation involves looking at the company's revenue streams, costs, and profit margins. The competition in the market, particularly from major competitors like Applied Materials, ASML Holding, and Tokyo Electron, requires detailed analysis. A comparison with these firms provides insights into Lam Research's market position and strategic advantages.

One of the critical elements for a comprehensive evaluation is to consult financial metrics. Earnings per share (EPS), revenue, market capitalization, the price-to-earnings (P/E) ratio, and dividend yield are key figures that should be assessed. Tracking and understanding these metrics offers insight into the valuation and financial health of Lam Research. Financial analysts also keep track of upgrades and downgrades.

The stocks price history is crucial when evaluating the investment potential of Lam Research. Reviewing the stocks performance from its first trading day reveals trends, volatility, and the stock's response to market events. This historical view provides context, making a more informed investment decision.

The company's strong performance stems from its position within the advanced semiconductor manufacturing industry. Its etching, deposition, and other advanced manufacturing technologies are key to creating the cutting-edge chips that power modern devices. As technological advancements persist in the semiconductor field, the demand for the companys equipment grows, potentially boosting revenue growth.

Geopolitical events and their potential impact on Lam Research is another key factor. The companys revenue stream may be affected by trade disputes, sanctions, and other forms of geopolitical instability. Investors should assess the risks associated with the company's reliance on international markets and the ongoing evolution of trade regulations.

Lam Research's long-term viability is anchored on its ability to innovate and adapt to the changing semiconductor landscape. This involves creating advanced manufacturing tools, building strategic partnerships, and responding swiftly to the market's shifting requirements. The company's capacity to maintain its industry leadership will determine its continued success.

The process of evaluating a stock involves an in-depth examination of the financial reports. This study includes in-depth scrutiny of financial statements such as income statements, balance sheets, and cash flow statements. A full analysis of the financial statements delivers an understanding of Lam Research's financial performance, liquidity, and solvency, providing the investor with a well-rounded perspective.

Considering all these factors, the decision to buy, sell, or hold Lam Research stock demands careful thought. Examining current market trends, analyzing financial results, and considering geopolitical risks are essential steps in the process. Understanding the company's position in the semiconductor manufacturing sector, its capacity for innovation, and its reaction to global developments are critical to making an informed decision.

Before making an investment decision, investors must consider the company's exposure to market and economic cycles. The semiconductor equipment sector is prone to cyclical trends, with periods of rapid growth followed by periods of downturn. The fluctuations in demand impact Lam Research's financial performance and stock prices. Therefore, assessing the companys responsiveness to these economic shifts is essential.

GuruFocus provides valuable information, including Lam Research stock prices, insider transactions, and financial data. This resource can assist investors in evaluating the company's performance and financial stability, and in understanding the perspectives of financial experts. The analysis provided by GuruFocus offers valuable insights into the company's market position and strategic direction.

In conclusion, Lam Research (LRCX) presents a complex investment opportunity. The companys strong market position and the demand for semiconductor equipment make it an attractive option. But investors must acknowledge the industrys cyclical nature, geopolitical risks, and the company's dependence on the Chinese market. Thorough research, including financial analysis, and assessment of market dynamics, are required for an informed investment decision. The potential investor must therefore weigh the potential benefits with these challenges before making a decision.

Detail Author:

- Name : Alexandra Lesch

- Username : cleveland.white

- Email : scarlett.jacobson@bailey.org

- Birthdate : 1975-04-02

- Address : 931 Schamberger Ports Aldaborough, NH 50300

- Phone : 484.986.5148

- Company : Haag-Herzog

- Job : Office Machine Operator

- Bio : Voluptate est vitae ratione earum maxime. Aperiam natus quo repudiandae doloribus error. Unde optio quo et dicta nam.

Socials

instagram:

- url : https://instagram.com/boyerk

- username : boyerk

- bio : Vel voluptatem amet ipsa minus corrupti debitis. Minima sed qui sint. Ab quo incidunt earum.

- followers : 1049

- following : 964

twitter:

- url : https://twitter.com/kallie.boyer

- username : kallie.boyer

- bio : Porro eius fugiat alias et. Temporibus exercitationem ab ullam quibusdam. Aut quas quo non quia explicabo.

- followers : 5609

- following : 2296